A shortened version of this article was first published in Equity magazine 23 Apr 2019 issue: https://www.australianshareholders.com.au/equity

______

With the abundance of data in this digital age, more than ever, private investors have the opportunity to stay ahead of the pack and find rewarding investment opportunities. But it’s not just about access to data. It’s about being clever and filtering for investment opportunities that others don’t see. In this article I’ll highlight a different approach to generating quality investment ideas by applying a different lens. I’ll also share some common pitfalls I’ve observed and experienced myself.

Start broad

You generally don’t attend an auction and buy a house just like that without having first looked at a variety of neighbourhoods and inspected multiple properties. Why? Because it’s helpful to have multiple data points to compare and consider. Yet in the investment world with even bigger dollars at stake, many investors have, whether conscious or subconscious, preconceived notions about certain asset classes, sectors and geographies. They prematurely make assumptions that constrict their universe without having first considered the wider world of opportunities. How do you know your favourite bubbly is champagne without trying or at least knowing about prosecco, cava or sekt?

The classic illustration of this is a phenomenon known as home country bias. Australian investors collectively hold 66.5% of their portfolios in Australian shares, yet Australian stocks represent only ~2% of the world’s stock market.[1] The same is true even in the US, where US investors allocate 79% of their portfolios to US markets, which although large, comprises only 51% of the world market.[2] Why is that? There is no plausible objective rationale linked to achieving more favourable investment returns by investing in this way. Other than perhaps fear of the unknown and comfort in the known.

Diagram: Despite the small size of the ASX, home country bias still exists[3]

Digitisation of just about everything has made data commoditised. Many private investors today have the same opportunity as the world’s largest fund managers to access global data. This has neutralised the huge informational advantage that institutional fund managers once had. The abundance of quantitative tools such as Morningstar, broking subscriptions, stock screeners and other filtering tools found online has aided the search process. Many of these tools are free. Though there are of course additional paid resources that investors who mean business should utilise. These include Factset, Capital IQ, Reuters and Bloomberg, some of which we ourselves employ at Lumenary Investment Management.

The lesson? There are a world of investment opportunities that exist if you start your search broadly. Begin with the widest available dataset and minimise the presumptions you make, be it geographies, industries or sectors. Start the dataset of your stock screener by capturing as much of the investable universe as you can, rather than having the inclination to filter opportunities out too early.

Know you will underperform

Assuming you’ve found a suitable data source for yourself as a private investor, how do you discover those hidden investment opportunities that others have missed?

To start, investors need to strive to be above-average. Being above-average means thinking and seeing opportunities differently to the rest of the herd. Which means taking a risk. You’re not going to catch alpha by following the pack.

Even though you may be trawling through the same information, that edge over the consensus comes from analysing it different and not having the same assumptions and consequently, conclusions. This is exactly what will lead you to opportunities others may overlook. But be prepared: being different evidently means performing better than others and potentially worse in certain periods.

Only investors who are comfortable venturing from the flock (and by definition, over-performing and under-performing the market average) should consider the below ways to view the world differently.

All companies are the same

Companies should be seen as vehicles for generating investment returns. It shouldn’t matter where the vehicle is domiciled, or what sector it belongs to. Its job is to get you from A to B the fastest by using the least amount of fuel. The outputs of the vehicle and its efficiency is what matters. Many investors can get sidetracked on proxy data, often industry-specific, when what ultimately matters is the profitability, solvency, efficiency of capital allocation, and growth potential of the company.

Counter-intuitive as it may be, yes, you should be comparing apples with pears and making a decision on which ones tastes better. Why sit there and select the best apple out of the orchard, when overall the pear still comes out on top?

Many investors are indeed too fixated on individualised sector-specific metrics when undertaking their stock analysis. To overcome the risk of missed opportunities, retailers should be compared with technology companies which should be compared with manufacturers which should be compared with pharmaceuticals. The metrics of comparison should be the same: the returns they provide the investor.

Using the same data but applying a different lens

In Moneyball[4], the Oakland A’s baseball team developed a specific statistic termed ‘on-base percentage’ and discovered it to be an excellent predictor of player success. Even though the source data was widely available, no other teams read the data and correlation as Oakland. Same data, but a different way of thinking. This difference in perspective gave the Oakland A’s an edge.

as Warren Buffett says, “You never know who’s swimming naked until the tide goes out.”

The same principle applies to investing. Investors should view timeframe as an important differentiator. Whilst most investors filter for a 3-5 year horizon, applying a longer view in your quantitative tools will give you a different lens. Quality companies come to the fore during adversity and the phonies are found out. A valuable lesson for those investors often caught up in bubbles is to increase the horizon of analysis to cover at least one market cycle (typically 8-12 years). A company may look great in over the short-term, but as Warren Buffett says, “You never know who’s swimming naked until the tide goes out.”. At Lumenary, we analyse companies over a 10+ year horizon to avoid the skinny dippers.

Even after you’ve searched and found quality companies, the process isn’t over – it’s just the start. A lot more work still needs to be done and here are some mistakes I’ve made, and have seen others make.

Caution: the common pitfalls

Rigidity

Stock screeners can help investors automatically filter a large universe, but be mindful that they are very black-and-white. For example, if investors screen for a threshold level of profitability, they may miss opportunities if a great company falls just shy of the required threshold. It’s still a great investment opportunity, but you would have missed it altogether. For this reason, we at Lumenary do not use automatic screens. We prefer to manually review financial data which allows us to exercise flexibility and human judgement. Human judgement is what allows us to consider various data sets for how we want to process and analyse it, rather than having a program form conclusions for us.

Price ignorance

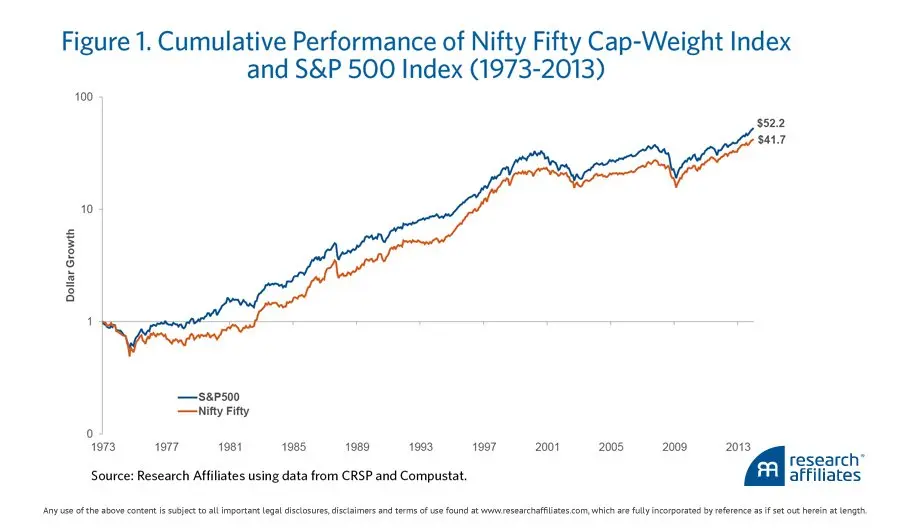

Many US investors in the 1960s and 1970s were burnt when they discovered that quality companies didn’t automatically lead to great returns. Surely investors couldn’t go wrong with quality companies such as General Electric, IBM, Gillette and Xerox? The issue, they found a decade later, was that the Nifty Fifty, as glamorised by institutional investors, were quality companies but purchase price was too high. The mantra ‘growth at any price’, isn’t a solid investment strategy. Even when you’ve found a quality company, the purchase price is still an important driver of future returns.

Diagram: The Nifty Fifty experience showed the importance of not over paying.

Ephemerality

When investors search for companies of high quality, they can become attached to particular metrics. As the Oakland A’s discovered, the profitability of rules-based methods diminishes as they become more popular. As more baseball teams adopted the ‘on-base percentage’, the more it became the average and eventually lost its effectiveness. The lesson for investors? Remaining above-average requires a continuous evolution of search criteria to remain ahead of the pack. Predictive models are successful for a period of time, but no universal rules persist forever. Be flexible and fluid to stay ahead of the pack.

Closing remarks

Data is critical for the search of new investment opportunities. For the enterprising investor seeking to be above-average, it’s critical to see the world with a different lens. Use data differently to develop alternative ways to filter stocks and don’t prematurely hinder your search. Quality companies have proven performance over the long-term, so measure them over a longer horizon, otherwise it becomes hard to differentiate the stayers from the sprinters. And just as you’ve discovered a quality company, remember this is just the start of the process. Much more work remains to then consider its competition, moat, management, business strategies and valuation.

Happy compounding.

About me

Lawrence Lam is the Founder of Lumenary, a fund that uncovers the best founder-led companies in the world. We invest in unique, overlooked companies in markets and industries beyond most managers’ reach.

Lawrence Lam

References

[1] https://personal.vanguard.com/pdf/ISGGAA.pdf

[2] ibid

[3] https://www.visualcapitalist.com/all-of-the-worlds-stock-exchanges-by-size/

[4] Hakes, Jahn, K., and Raymond D. Sauer. 2006. “An Economic Evaluation of the Moneyball Hypothesis.” Journal of Economic Perspectives, 20 (3): 173-186.