This article was first published in Money Management magazine, 16 July 2020

———-

We are all baking cakes. The wealth cake. We search for the highest quality ingredients, we put those ingredients into a mixer, then the oven, and voila – here’s one we prepared earlier. With the right recipe, some will end up with a creation that is magnificent, fluffy and moist, far superior to others. But those that get it wrong can end up with a sad puddle of mess. This is high stakes baking where the best result depends not only on having the best flour, freshest eggs, and best elements, but applying them in the right quantities, timing and method. If stock selection is akin to picking the ingredients, then we are only part way there in our quest for alpha. How we allocate also has a big contribution to the result. In this publication I will outline how our fund captures alpha through stock selection, weighting and allocation.

Outperformance originates from unconventional means

You do not win a race by driving in the same lane. Remember, the source of alpha is, by definition, unconventional. It is common for stock analysts to focus on specific sectors or geographies but these attributes are not advantages unique to any one company or investor.

One of the largest and most successful active managers in the USA, Capital Group, failed several times to launch their Best Ideas fund which took the best single idea from each of their sector specialists. The Best Ideas fund was appealing in theory, but it underperformed because selecting the best companies from each sector is vastly different to simply selecting the best companies full stop. What they thought would be a source of alpha turned out to be a limitation in their stock selection.

How to catch alpha through stock selection

In order to find the freshest ingredients, immerse in catchments where they are most likely found. The first source of alpha comes from either company-specific or investor-specific attributes. Company-specific examples may include board or management characteristics, spin-offs, capital raisings and other corporate actions where unique opportunities flash by for those paying attention. Investor-specific examples include long-term ownership mindset, high concentration, or lower trading frequency.

Lumenary are experts in founder-led investing – our companies possess a source of outperformance tracing back to an aligned governance and decision-making structure at the core. We find this a profitable universe to play in – founder-led companies have achieved a 7% outperformance over other companies since 2006. The narrower the focus on the source, the better. As you would expect, the source of alpha is not wide. This is a scenario where you would rather delve deep than go wide. Become a specialist rather than a generalist. For example, I have written previously about some niche opportunities I am seeing in technology.

Once you have found your source of outperformance, the allocation plan can be built around that foundation by fine-tuning the focus even further.

How to fine-tune an advantage

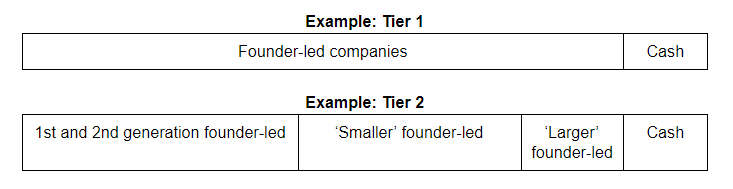

For instance, founder-led companies tend to outperform over the long-term. But this is not the end of the story, this is just the first tier of advantage. Investigate further to find secondary tiers, tilt the allocation towards these additional pockets of opportunity, and press the advantage further.

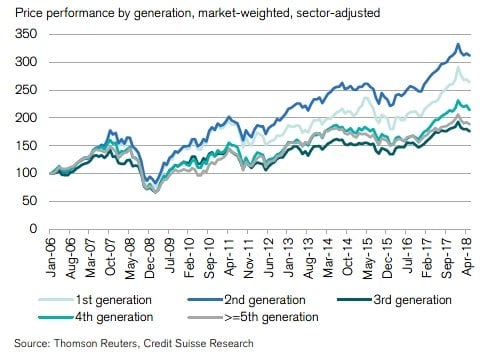

By way of example, contrary to popular belief, the saying “the first generation makes it, the second spends it, and the third blows it” is simply not correct. The data shows a different story altogether. The often (unfairly) maligned second generation is in fact the cohort that delivers the greatest source of performance for founder-led companies. The building of businesses takes time, becoming a dominant player takes years, and it is often the new ideas of the second generation that changes the game, as the foundations paved by the first generation are expanded and taken to new heights by the second.

As a second tier advantage, we find first and second generation founder-led companies particularly appealing.

Contrary to popular belief, the second generation adds the most value

If the source of your advantage comes from other origins, find the additional tiers that have the potential to generate the most alpha. Specialists in capital raisings might investigate further to determine whether rights issues, hybrids, or debt opportunities generate the greatest outperformance, for example.

Identifying more advantages

Identifying more secondary tiers will enhance the ability to allocate with a greater degree of conviction. Taking you back to our example, we have established one source of deeper advantage – first and second generation founder-led companies.

Again we will turn to research to inform our investigation into other secondary tier advantages, guiding our approach to allocation. Long-term research found smaller companies (under USD $3 billion market capitalisation) have greater propensity to compound. “Small” in a global context, are founder-led companies under USD $3 billion in size. Skewing a founder-led portfolio towards these up-and-comers boosts exposure to challengers who have the motivation to topple market leaders, and have the runway to execute.

‘Smaller’ founder-led companies outperform larger brethren

To illustrate further, a specialist in capital raisings may sniff out certain uses of funding to have foretelling properties as to whether likely future success is imminent. The impact of the coronavirus has forced many companies to raise equity at dilutive prices; the use of these funds will determine the long-term success of these companies. Find the attribute and allocate heavily towards it.

How to allocate using a tiered approach

Sensible investors will acknowledge that basing allocations on research which can be high-level, will provide general guidance, but is limited in its practical considerations which still need addressing when putting actual money to work. In the search for outperformance, how do we allocate with a balanced approach to risk management and concentration?

Simply because a company is run by the daughter of a founder and under $3 billion in size does not automatically guarantee it will outperform. As long-term investors will appreciate, the purpose of portfolio allocation is just as much to protect downside as it is to seek upside. A balanced diet approach is healthiest – everything in moderation. Skew towards the source of outperformance by all means – first and second generation founder-led companies and companies under USD $3 billion, but be mindful to hold cash according to the market climate, and in our case, we balance out the volatility with a blend of larger, more stable founder-led companies.

The all-weather founder-led portfolio is one dominated by first and second generation companies, companies under USD $3 billion in size, rounded out with a small proportion of larger, steady-state companies which act to temper volatility. Of course the level of cash is important and will depend on prevailing market conditions. In this current climate, there will be more attractive opportunities to come, especially with the possibility of a second wave of coronavirus. As I have written previously, Lumenary has adopted a mindset of opportunism in this environment.

To summarise, the allocation strategy should go past the first level of alpha, but seek to identify secondary tiers, tilting even further within that set, which should be the predominant weighting of the portfolio. An appropriate level of cash and mixing in some companies less susceptible to large price fluctuations will balance the portfolio’s volatility.

Investigate beyond the first tier of outperformance

Closing remarks

How you select from the universe of investment opportunities around the world and how you weight these investments has significant bearing on your returns over the long run.

The search for outperformance requires a bold conviction to do things differently to others, a high level of specialisation in overlooked areas of opportunity, and improvement on traditional approaches. Outperformance can be found in a wide variety of areas so remain vigilant for company-specific traits where you can cast your net.

Once you find the source of your advantage, keep the stock selection confined within that zone, examine closely and leverage tier 2 benefits by apportioning heavily into those areas. This is the process of progressively tipping the scales in your favour by concentrating your exposure in high potential areas.

Happy compounding.

About me

Lawrence Lam is the Managing Director & Founder of Lumenary, a fund that uncovers the best founder-led companies in the world. We invest in unique, overlooked companies in markets and industries beyond most managers’ reach. We are a different type of global fund – for more articles and information about us, visit www.lumenaryinvest.com